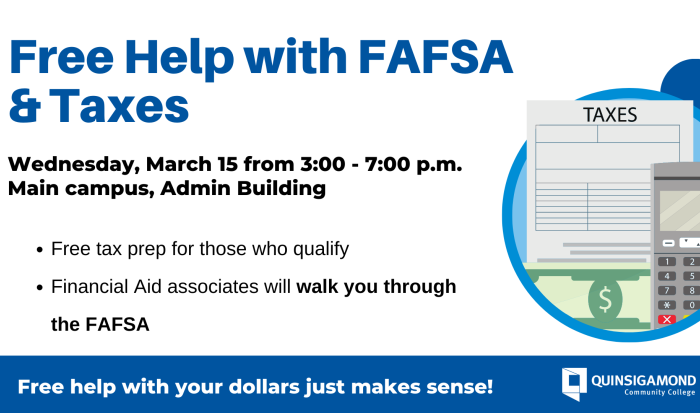

QCC is offering the public free assistance with the Free Application for Federal Student Aid (FAFSA) filing process, as well as tax preparation on Wednesday, March 15 from 3:00 p.m. - 7:00 p.m. at 670 West Boylston Street, Worcester, in the Administration Building. FAFSA workshops will take place in rooms 377A and 378A. Tax preparation will take place in rooms 177A and 178A.

The FAFSA is used to determine eligibility for federal, state and institutional aid, including grants and scholarships. QCC’s financial aid staff will walk participants through the FAFSA process. The priority filing date for the FAFSA is April 1, 2023.

“Students can sometimes feel apprehension filing their FAFSAs and tax returns. QCC is happy to provide support to complete both processes as both are important steps to accessing state and federal funding to complete post-secondary education. It is important to file early because there is a limited amount of aid available that mostly gets distributed on a first come first served basis,” said Vice President of Strategic Enrollment & Student Engagement Michelle Tufau Afriyie.

QCC’s Volunteer Income Tax Assistance (VITA) program will offer free tax preparation for qualified individuals. This is an IRS initiative designed to support free tax preparation services for low-to moderate-income individuals (people who generally make $58,000 or less), persons with disabilities, the elderly, and limited English speakers. QCC’s IRS-certified volunteers offer these services to approximately 500 people annually. The VITA program assists with basic tax situations; however, volunteers cannot file for business owners, homeowners, or other situations. Tax assistance will be offered for March and April. There are four different VITA sites in Worcester: Main South CDC, WCAC, Plumley village, and Worcester State University. For more information, please contact vita@qcc.mass.edu.